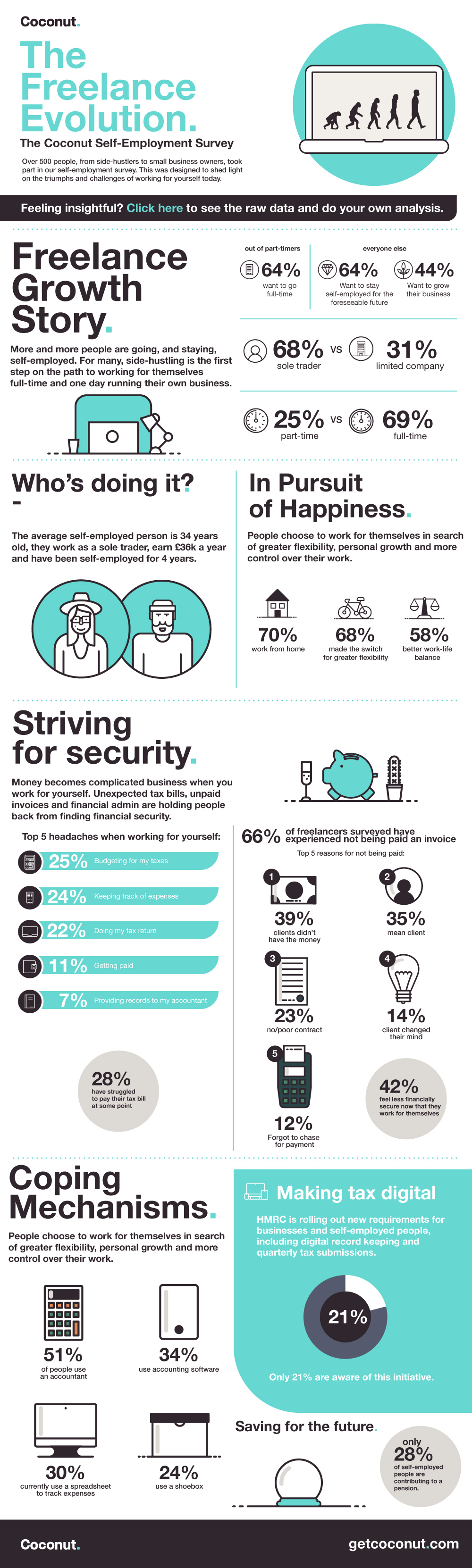

The results are in, and they’re evolutionary.More than 500 people took part in the survey, thank you. Freelancers and self-employed people from all walks of life shared their experiences.If you're feeling inquisitive and want to do some analysis of your own, you can find the raw data here. If you find out anything interesting, do share your insights with the community.

Highlights

We've put our analysis in an infographic below, but here are a few highlights:

- Many people start out freelancing on the side and quickly fall in love with the freedom and flexibility it brings to their lives. According to our survey, well over half of current side-hustlers want to become self-employed full-time.

- Out of those who were already working for themselves full-time, 64% had no plans of returning to traditional employment and 44% want to grow their business.

- Taxes consistently clocked in as the biggest headache for self-employed people when it comes to finance. Whether it's budgeting for them, saving for them, or filing your tax return, taxes appear to be the bane of self-employed life.

- Having an accountant doesn’t eliminate the problem either. Despite over half of the people we surveyed saying they employed an accountant, budgeting for taxes was still cited as the second biggest hassle for this group.

- Sadly, getting paid on time, or in some cases at all, is still a challenge for self-employed people. In many cases its the client's fault, with lack of funds and 'meanness' being cited as top reasons for not being paid.

Infographic

Here's our full infographic. You can also find the raw data here if you fancy doing your own analysis: