You may know that we used to provide current accounts. You may not know we stopped opening current accounts on 1st January this year.

Instead, we built a way of un-muddling personal and business expenses for sole traders and accountants, using bank statement feeds from any bank.

Business and personal usually a muddle

Accountants and bookkeepers that work with sole traders know that their business and personal finances are often muddled together.

Even if they have a business account, there will often be transactions flowing through personal accounts, credit cards and cash.

Imagine if clients and you could un-muddle business and personal without having to open a new bank account?

A prolific challenge, unique to sole traders

An estimated 75% of sole traders use a personal account to manage their business. The remaining 25% often have business transactions in personal accounts or credit cards.

Whilst banks don’t really like sole traders using personal accounts for business, it’s rare that accounts will be shut or business fees be applied. This means that it’s hard to get sole traders to change their behaviour.

This muddling of personal and business is a very unique sole trader problem.

"Coconut imports statements from any bank in real-time, so my sole traders don't have to switch. It makes my life a lot easier."

Jamie, Tax Ninja

Why do muddled finances make life harder for everyone?

Unpicking business from personal creates work in gathering accounting information and filing returns, impacting your ability to serve clients in busy times and reducing your ability to grow your practice.

What’s more, until you or the client organises their transactions and crunches the numbers, it’s almost impossible for you or the the client to track business performance and tax.

Can I solve this with cloud accounting software?

Cloud accounting software is like cracking a nut with a sledgehammer for managing sole traders, so the simple answer is: no, not really.

Cloud ledgers are setup for limited companies, so the user interface doesn’t work well for this situation.

What’s the solution?

At Coconut, we got really excited about the opportunity to solve this because we only build software for sole traders and their accountants & bookkeepers.

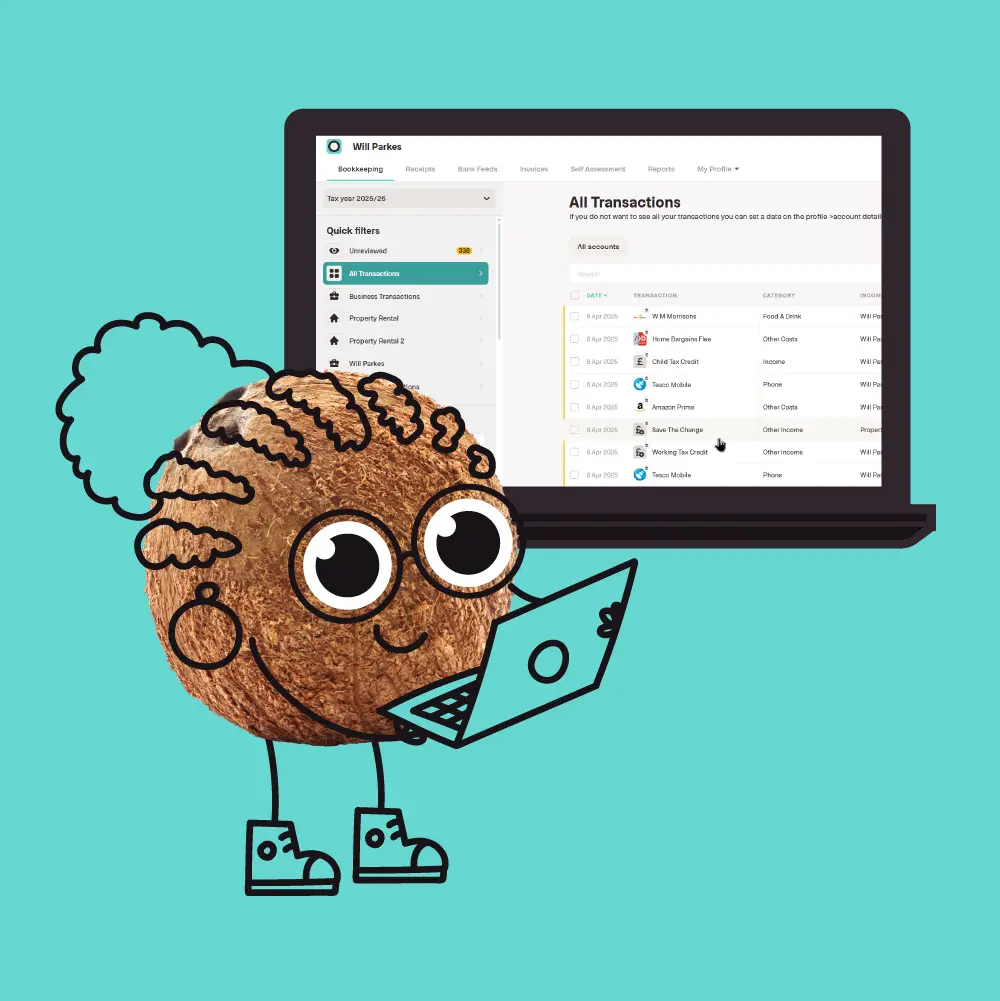

We’ve come up with a new way of un-muddling business and personal from any bank account or credit card, making it very easy for sole traders to keep their books in order.

- Client connects personal, business and credit card accounts to Coconut, and we show bank statements from each

- They set the rules at the bank or transaction level for transactions to be filtered into their consolidated business view

- There’s a really simple 3 button interface, making it a job that can be done in seconds

- You get to see only business transactions, regardless of whether they use a business account, or not

And it's so easy to manage with our 3 button selector. Why would anyone need to switch or open a new bank account?

What are the other benefits of this?

This is perfect for sole traders in any industry. They can also manage cash transactions.

It’s also great when they are just starting out and only have a personal account. You can get to know them straight away and offer market leading technology.

They can even use Coconut before they’ve connected their bank account. You can collect digital receipts and invoices from clients. You can also send invoices too. They can connect when they are ready.

Get in touch if you'd like to chat

We're always up for a chat with accountants and bookkeepers about sole traders and making them your favourite clients. You can book a call with us directly here.

.jpeg)